How Close Are We To A Housing Bubble

- Daniel sisto

- Apr 26, 2016

- 4 min read

As many of you will remember, the last housing crisis started in 2007 and reached new lows in 2012. This crisis affected more than half of the United States. The credit crisis was the result of the burst of the housing bubble.

In short the main reason for this collapse was lenders/banks were giving out mortgages to anyone and everyone. The reason they did this was because they ran out of qualified participants and in order to keep making money they needed to issue more loans (so people with no credit, no job or any trace of financial stability were getting loans/mortgages). So the collapse began and lasted years and took jobs away from the middle class, left millions unemployed, homeless, and took millions from peoples retirement. Several of the banks who were involved, had a tremendous amount of exposure to this activity. So when the market collapsed, these banks went right with it - several filed bankruptcy.

"In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration." Housing Bubble | 2007 - 2012

The Current Bubble

The reason that the government bailed out these big banks was to help American families but in actuality many were kicked out of their homes for missing payments. As homeowners missed these payments, banks began to foreclose on their homes due to lack of payment (these banks missed larger payments). Somehow an increasing number of homes were being bought, however the increase in Americans renting was growing rapidly. We have come to realize that these homes were being bought cheap by investors, hedge funds and foreign money. These banks were selling debt packages (lots of foreclosures) to these folks for 30-40 cents on the dollar.

Rent prices have skyrocketed over the past several years, yet American's incomes have stayed the same. Typically rising home prices and rising rents would depict a healthy real estate market - that more families are buying - but it is truly a sign of the market being manipulated.

Take a look at the housing value index (to the left). It looks fairly clear that we are approaching price levels when the recession began.

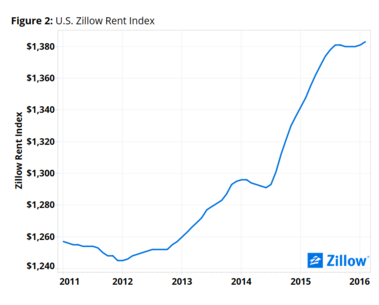

To the right, take a look at the rental market since that start of 2012 when it hit a low (when the recession started to end) and how the rental rates have increased over the past couple years. As you can see from the chart to the right, it looks like these rental prices have already started to hit a plateau. (or may breakout and continue to rise)

As you can see both home prices and rental rates have been soaring through the roof since the recession ended.

The only issue we have with these statistics is that income levels of American families are not keeping up with this increase.

As you can see from the photo to the left, Americans incomes are increasing at a very gradual pace (basically keeping pace with inflation - besides the top earners)

So What Does This All Mean?

Americans are now having to spend 50-60% of their incomes just to make their rent payments or mortgage payments. The big banks and lenders have effectively created another bubble. Americans are reaching a point where they will no longer be able to afford the payments for their homes or keep up with their rents. If this is the case and Americans begin defaulting on their loans, we could potentially end up in a similar situation as we found ourselves in 2007. One difference will be that there are currently millions of more renters in 2016 than in 2007. These folks will not get foreclosed on but will essentially not have a place to live. The manipulation in the market is becoming an issue. If rents continue to rise and home prices follow suit, we will reach a point where average people are no longer going to be able to afford to live. If we reach this point and people begin to default, there is no telling how severe this could impact our economy.

The fear that I have is, renters are beginning to speculate that the housing market is stable again due to rising prices and such and do not truly understand the market is being manipulated. These renters are going to start to buy homes at the wrong time, when prices are dramatically over priced, and this is only going to add gas to the fire and increase the price of homes and increase the likelihood of people defaulting on their homes.

I am not saying that this is going to happen tomorrow or the next day. All's I am saying is to be aware of what is going on and understand that the housing market is NOT hot. It is not a stable housing marketing. Their are outside variables that are causing this movement.

Leave your comments below, let us know what you think about the current state of the real estate market. Do you think we are in a bubble? think the real estate market is stable? Or were bound to burst any minute?

We would love to hear your opinion on the topic.

www.hspropertyfunds.com

Let Us, Help You

(315)516-8023

hspropfunds@gmail.com

Comments